Official WeChat

Construction Materials Industry Prosperity Index (MPI) for November 2023 - Construction Materials Industry Operation Remained Stable in November

Construction Materials Industry Prosperity Index in November.

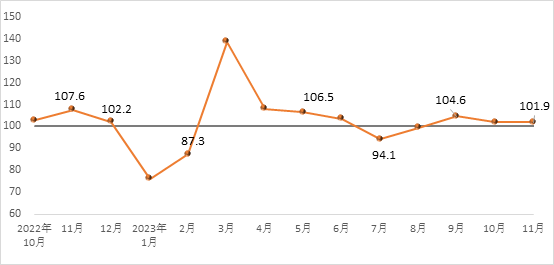

2023 November building materials industry boom index was 101.9 points, up 0.2 points from the previous month, higher than the critical point, in the boom zone, building materials industry operation remained stable.

Figure Construction Materials Industry Monthly Prosperity Index

On the supply side, in November, the price index and production index of the building materials industry were higher than the critical point. Among them, the building materials industry price index 100.4 points, the same as last month, building materials product prices showed signs of stabilization; building materials industry production index of 101.5 points, 0.1 points higher than last month, building materials product production remained stable. Demand side, building materials investment demand index, industrial consumption index, international trade index are higher than the critical point. Among them, building materials investment demand index 101.1 points, 1.0 points lower than last month, higher than the critical point, building market demand rebound has slowed down; building materials products industrial consumption index 103.7 points, 2.3 points higher than last month, and building materials products are more closely related to the application of the manufacturing industry demand has increased; building materials international trade index 105.7 points, 6.3 points higher than last month, back to the boom! International trade index of building materials 105.7 points, up 6.3 points from the previous month, rebounded to the boom zone, building materials commodity exports increased.

II The MPI impact factor analysis and early warning

Building materials production remained stable. in November, the production of key building materials products remained stable, slightly accelerated, wall materials, waterproof building materials, heat insulation and thermal insulation materials, clay and gravel mining, building stone, construction technology glass, mineral fiber and composite materials, building sanitary ceramics, non-metallic mining industry and other 9 sub-industry production index than the previous month to varying degrees of rebound, the building materials market demand remained stable. Product prices showed a stabilizing trend. In the 13 building materials industry, cement, concrete and cement products, wall materials, waterproof building materials, lime gypsum, clay and sand mining, construction stone, building sanitary ceramics, building materials, non-metallic mining industry and other 9 industries, product prices rose. Architectural and technical glass, fiber-reinforced composite materials, non-metallic mining industry, such as 3 industry product factory prices to maintain year-on-year growth. But the price growth momentum is insufficient, the relationship between supply and demand in the building materials market is still not a significant improvement.

Building materials industry operating environment is facing volatile changes. Currency, finance, real estate and other areas of control policies are conducive to the improvement of macro expectations. According to the monitoring information, in November, the downstream project payback has improved, part of the regional project construction and key projects to catch up with the phenomenon, to support the market demand is stable. Current market demand is still dominated by stock projects, with the climate turning cold, cement and other building materials supply and demand will appear seasonal weakening, enterprise production should be prudent response. Recently, the price of coal has fallen, and the price of liquefied natural gas is still rising, gas-using enterprises should respond in advance to prevent the risk of supply fluctuations under extreme weather conditions.